MEKSMART

GENERAL NEWS

Author: Vương Vũ

Update: 14/12/2022

LARGE ROOM FROM THE COLD CHAIN MARKET

Most cold supply chains in Vietnam are run by small and medium-sized suppliers, so investing in cold storage centers is still a big area.

.jpg)

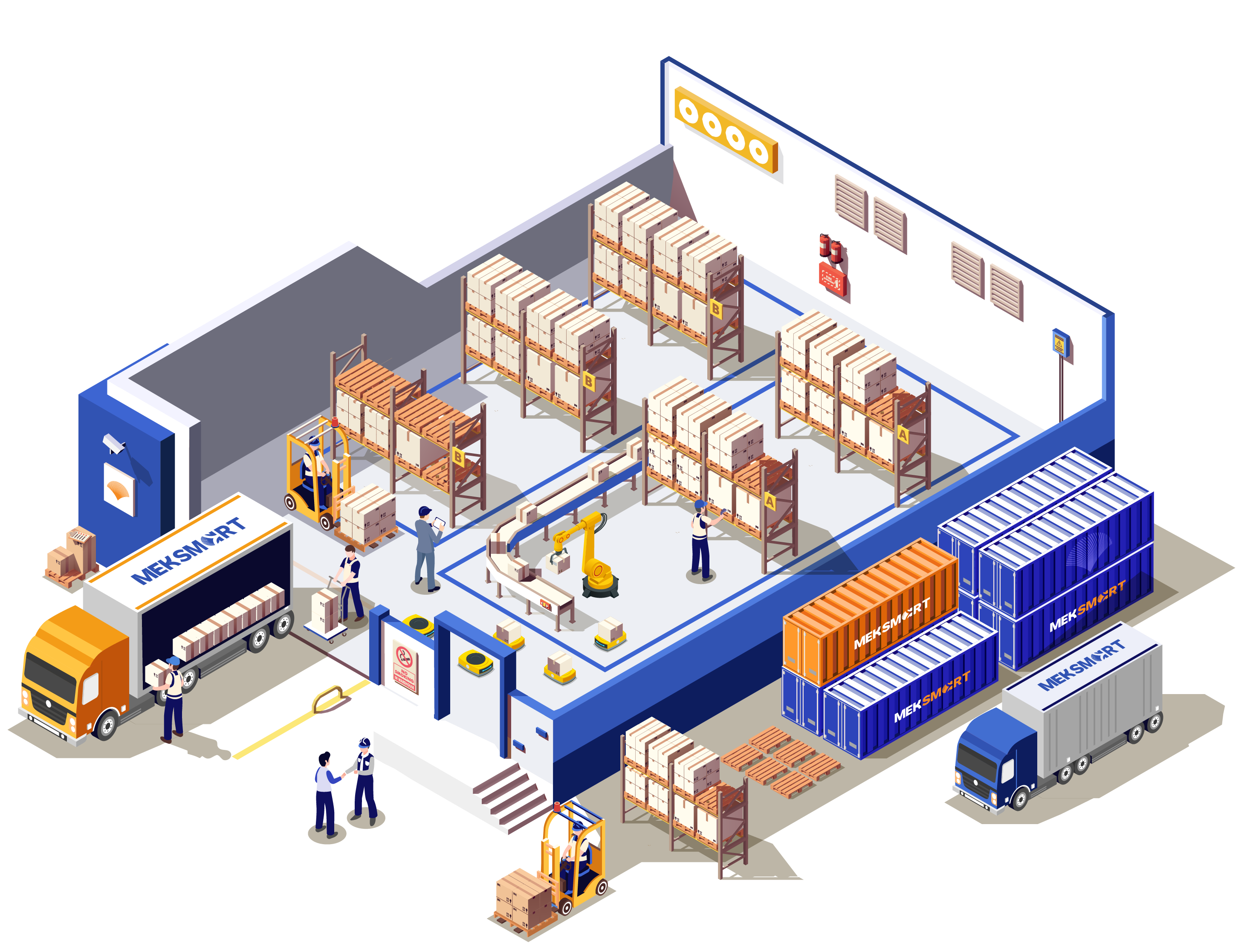

Currently, 53.7% of Vietnamese logistics service enterprises provide warehousing services. Thus, warehousing services continue to be one of the main supply services of Vietnamese logistics enterprises. The current concern is warehouse management technology and investment capital to develop warehouses to promptly meet the requirements of production and import and export, especially frozen warehouses and frozen supply chains.

In 2021, a series of cold chains open more facilities in countries, as well as pay more attention to safety and adaptability in the new context.

As of September 2021, the country has 48 cold storage with a capacity of 600,000 pallets. Which, the South has 36 cold storages with a capacity of 526,364 pallets. The Central region has 1 cold storage with a capacity of 21,000 pallets and the North has 11 cold storage with a capacity of 54,780 pallets. About 80% of cold storage has a high utilization rate. The cool storage utilization rate is low. Refrigerated vehicles, the country has more than 700 refrigerated vehicles and 450 rail cars carrying refrigerated containers.

However, the cold chain market in Vietnam is considered to meet only a very small part of the needs of manufacturers, retailers, and businesses. Meanwhile, cold storage supply is mainly concentrated in the southern region due to large demand, with about 60% of the market share held by foreign investors.

According to recent studies, just over 8% of producers and distributors for the domestic market apply cold supply chains to preserve goods, and this can also be considered one of the main reasons leading to the high rate of spoilage of agricultural products after harvest in Vietnam, accounting for 25.4% of total production. For export markets, manufacturers and distributors are also often affected by objective factors that prolong the process of bringing products to customers, the demand for cold chains is constantly increasing with production scale.

Mr. Dao Trong Khoa, Vice Chairman of the Vietnam Logistics Service Business Association, said that the cold logistics segment (including cold storage) in Vietnam is the niche segment of the logistics industry, but is developing the "hottest". Before the COVID-19 epidemic, the annual growth rate in this segment was 11%-12%. However, most cold supply chains in Vietnam are run by small and medium-sized suppliers, so investing in cold storage centers is still an area with great room.

Vietnam's seafood exports are the 3rd largest sector in the world, the industry that occupies the coldest cold storage area. During the peak of the COVID-19 epidemic, 30-50% of seafood export orders were canceled, leading to escalating inventories and cold storage having to operate at full capacity. Facing that situation, some seafood processing enterprises are oriented to invest in cold storage to serve the production. However, only very few enterprises with large production scales and abundant reciprocal capital have this orientation, most smaller-scale enterprises still need to use cold chain services, which is seriously lacking in Vietnam.

According to Truong Dinh Hoe, General Secretary of the Vietnam Association of Seafood Exporters and Processors (VASEP), the cold storage system is a core link for both Vietnam's seafood production and export chain. More broadly, agricultural products, food, pharmaceuticals ... There is also a huge demand, forming a potential market that is still open in the current logistics system.

However, investing in a cold chain is also a big challenge because this is an industry with high investment costs, especially when building a closed system from warehouses to transport vehicles. In addition, the requirements on the level of science and technology of the parties involved are also a big barrier. Therefore, to invest in cold supply chains, businesses need to prepare themselves with stable internal resources, along with the companionship and support of the state, not only to effectively exploit this billion-dollar market but also to contribute to promoting production activities, Vietnam's trade is growing.

The sudden increase in demand means that many logistics businesses have to accelerate innovation and apply new technologies to keep up with the trends and requirements of customers. Cold chain logistics in particular must find ways to increase efficiency during transportation. In the short term, cold chain logistics will focus on stockpiling food, pharmaceuticals, and COVID-19 vaccines, Mr. Khoa said.

Euromonitor's report said that the size of the food market to be transported in Vietnam's retail industry, excluding seafood, is estimated at 1.2 billion USD in 2019, while healthcare pharmaceuticals depend on a cold chain of up to nearly 10 billion USD in 2020.

Resource: Business Forum